Identifying and hiring a qualified Chief Financial Officer (CFO) can be complex and costly. Our Fractional CFO service provides companies with the opportunity to be supported by a dedicated team without the burden of a full-time financial director.

Our CFOs adapt their expertise to your business needs and goals, becoming an integral part of your team. Whether it is cash management, strategic planning, or risk mitigation, you will be supported in every stage of development, and provided with tools and information needed to optimize strategic and operational decision-making.

Financial Account Services

Our goal is to optimize the organization and the coordination of the Administration, Finance Management and Control area, allowing top management to focus on high-value-added activities. A dedicated team of Fractional CFOs will assist you in the production and management of accounting data necessary for proper strategic planning and for the development of integrated dashboards and reporting tools.

Key Activities of the Administration, Finance Management and Control Area

- Business management customized support

- Accounting and extra-accounting data entry verification

- Identification of misalignments in the classification of accounting entries

- Review of data through the development of a provisional balance

- Guidance in correcting discrepancies in accounting entries

- Reclassification of accounting entries according to regulations and financial criteria

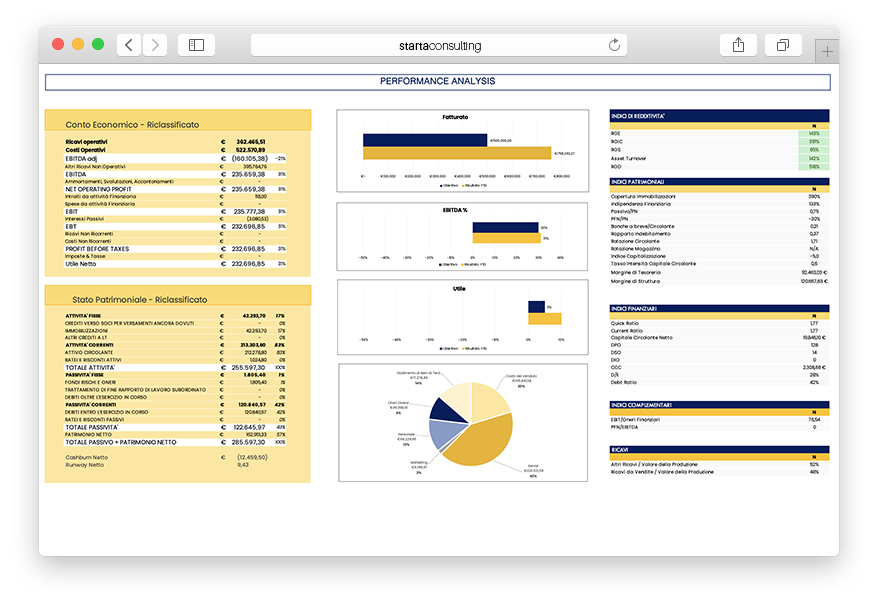

- Performance Analysis

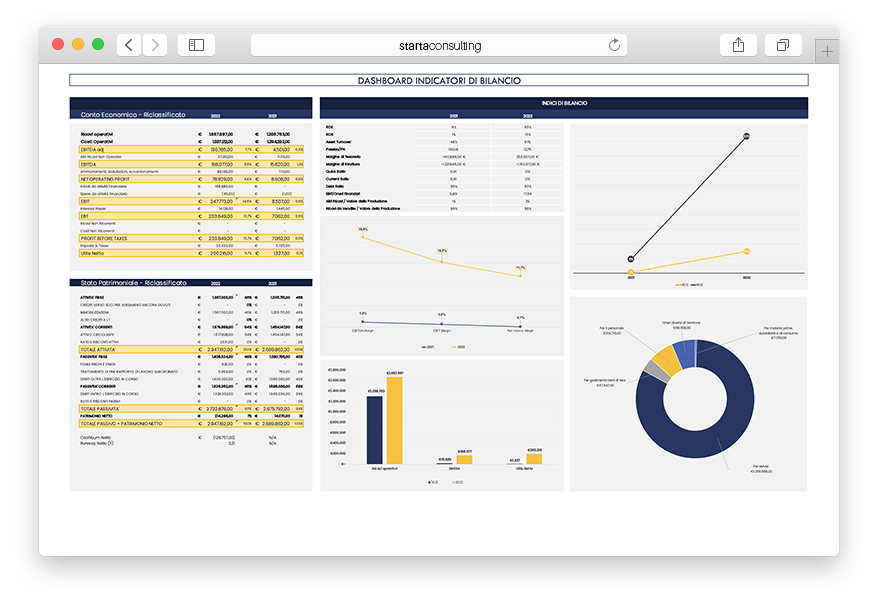

- Creation of monitoring dashboards with integrated reporting

- Business development strategies planning

- M&A operations management support

Management Control

Starting from the company’s objectives in terms of revenue and budgeted cost forecasts and a detailed analysis of accounting data, we develop customized monitoring tools and dashboards to provide a clear and timely view of the company’s financial health. This allows our clients to:

- Maximize profitability by scrutinizing income trends in terms of EBITDA, EBIT, and other key indicators aimed to measure and promptly interpret business performance, facilitating the implementation of corrective strategies.

- Enhance equity solidity through a comprehensive analysis of the equity trends in terms of net worth and assets and liability’s structure.

- Optimize cash flow by strategically planning current and future cash streams to prevent liquidity deficits and design sustainable investment policies.

- Plan development strategies by identifying the best investment coverage options (Grants, Bank Credit, Equity Investments).

Advantages

- Improve cost management

- Plan cash flows and anticipate liquidity needs

- Monitor company’s performance at any time

- Identify critical areas

- Evaluate corporate investments’ sustainability

- Assess tax impact on the business

- Improve the efficiency of business units and production processes

- Manage information flows efficiently

Financial Planning & Valuation

Transforming today’s challenges into opportunities to improve your business.

Fundraising Planning

Prepare for the next round and accelerate the growth of your business.