Fundraising planning is a critical activity for all companies, especially for startups and SMEs.

Weather in early-stage or expansion phase, an effective fundraising strategy is paramount for the company to secure the necessary cash flow to sustain investment need and ensure sustainable long-term growth.

Fundraising Planning

In a landscape characterized by the relentless pursuit of innovation, the ability to ensure sustainable growth is the secret to success for an innovative company. Capital raising, or fundraising, is the catalyst for this growth, enabling companies to push beyond the boundaries of their initial potential, facilitating expansion, access to strategic resources and development of innovative products and services.

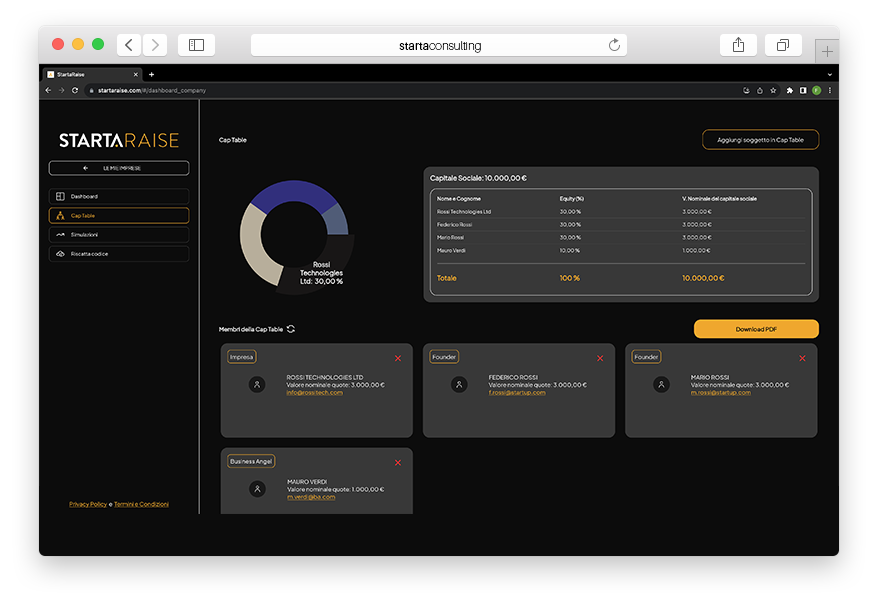

Given the high degree of innovation that distinguishes startups, these companies tend to set a higher valuation than the book value measured by Net Equity. It is therefore crucial to accurately calculate the offering price of shares to investors and conduct a diligent analysis of equity dilution following the closing of the financing round.

Discover our Fundraising Planning tool

Model multiple fundraising scenarios, manage equity dilution and monitor the evolution of your cap table

Advantages

- Effectively plan your fundraising strategy

- Identify a fair valuation based on the percentage of the transferred equity

- Calculate the percentage of ownership to be transferred to investors

- Monitor the evolution of the cap table

- Model multiple fundraising scenarios

- Determine price per share and total premium

- Analyze the dilution of founders’ and shareholders’ shares

- Strengthen your negotiation power

Financial Planning

Transforming today’s challenges into opportunities to improve your business.

.

Fractional CFO

Monitor financial performance and improve corporate profitability.